Unlock the Future of Secure Banking with Reusable Credentials

Using unbreakable encryption, Anonyome Labs can help revolutionize every part of your operations to stop fraud while still providing an exceptional journey for your customers.

Our identity technology allows you to only have to verify a customer once. From the time they sign up for an account, you will be completely confident in who they are. Every login, call center interaction, and branch experience will be seamless and secure.

Begin today to:

Prioritize Customer Convenience

Terminate Fraud

Revolutionize Operations

Stay Digitally Progressive

Begin today:

Prioritize Customer Convenience

Terminate Fraud

Revolutionize Operations

Stay Digitally Progressive

Prioritize Customer Convenience

Unbreakable security, breezy member experience

Say goodbye to “What is your mother’s maiden name?”. No more repetitive verifications— continuous and secure access that transforms every touchpoint into a seamless experience.

We’re making traditional KYC methods obsolete

1. Call Centers

With Anonyome’s Sudo Platform, the customer’s identity is securely verified during the initial account setup. Any subsequent interactions at the call center are seamless, as the system recognizes the customer’s unique credentials. This prevents unauthorized access attempts, reduces the risk of social engineering attacks, and ensures every call is secure and legitimate. Not to mention, it drastically cuts call times.

2. In-Branch Transactions

Traditional in-branch processes usually involve cumbersome paperwork and multiple identity verifications. With Anonyome, the customer’s identity, established during the account setup, is instantly recognized. The streamlined process expedites the transaction and eliminates the risk of fraudulent attempts, as our system ensures that only legitimate customers gain access to sensitive transactions.

3. Drive-Through Services

Anonyome’s technology eliminates the need for physical documents or additional verifications, preventing potential fraud attempts during drive-through transactions. The result is a convenient, secure, and frictionless banking experience for customers on the go.

4. In-App Transactions

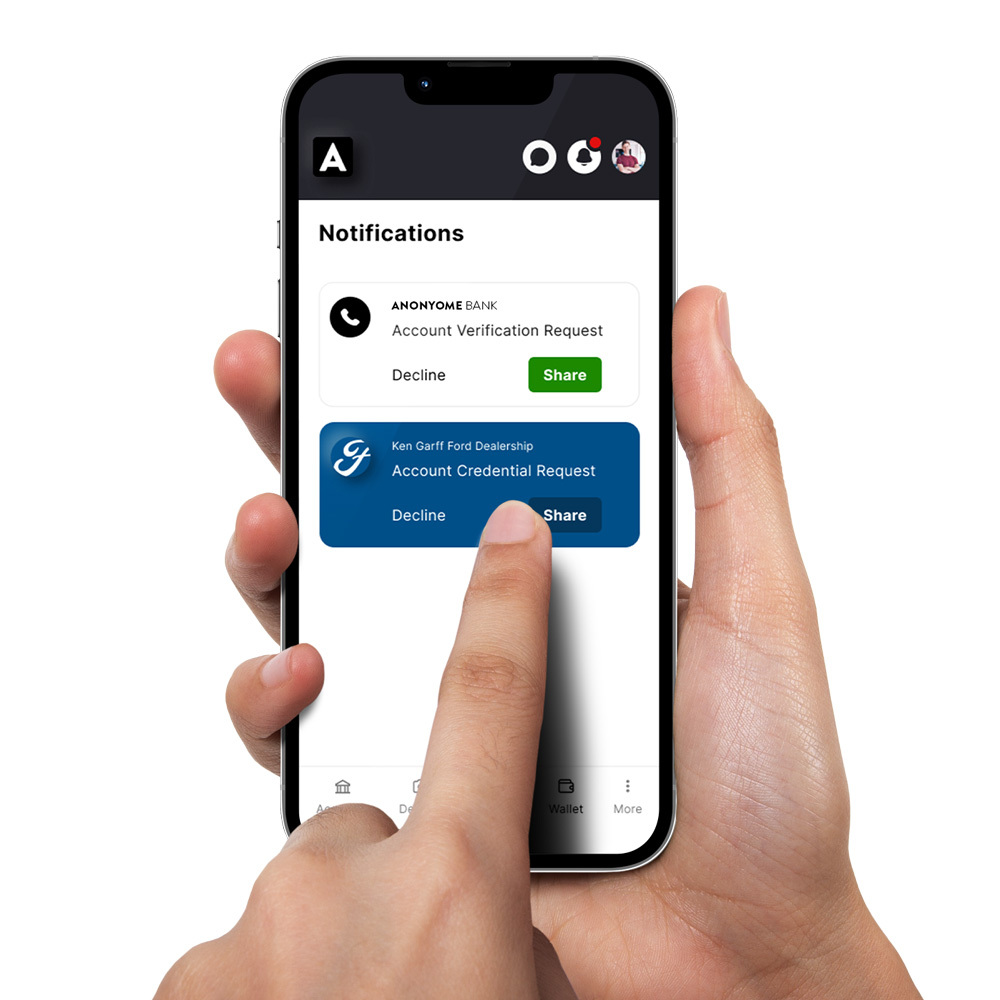

For customers accessing their accounts through a mobile app, Anonyome’s technology ensures a secure and fraud-resistant environment. There is no need for a separate app. Anonyome will seamlessly integrate into your existing app.

5. Online Banking

Whether customers are logging in to check their balance or opening an account online, our platform establishes a secure gateway between you and the customer during account creation. This secure line of communication thwarts phishing attempts and unauthorized access, providing customers with peace of mind and you with confidence in the authenticity of online interactions.

We’re making traditional KYC methods obsolete

1. Call Centers

With Anonyome’s Sudo Platform, the customer’s identity is securely verified during the initial account setup. Any subsequent interactions at the call center are seamless, as the system recognizes the customer’s unique credentials. This prevents unauthorized access attempts, reduces the risk of social engineering attacks, and ensures every call is secure and legitimate. Not to mention, it drastically cuts call times.

2. In-Branch Transactions

Traditional in-branch processes usually involve cumbersome paperwork and multiple identity verifications. With Anonyome, the customer’s identity, established during the account setup, is instantly recognized. The streamlined process expedites the transaction and eliminates the risk of fraudulent attempts, as our system ensures that only legitimate customers gain access to sensitive transactions.

3. Drive-Through Services

Anonyome’s technology eliminates the need for physical documents or additional verifications, preventing potential fraud attempts during drive-through transactions. The result is a convenient, secure, and frictionless banking experience for customers on the go.

4. In-App Transactions

For customers accessing their accounts through a mobile app, Anonyome’s technology ensures a secure and fraud-resistant environment. There is no need for a separate app. Anonyome will seamlessly integrate into your existing app.

5. Online Banking

Whether customers are logging in to check their balance or opening an account online, our platform establishes a secure gateway between you and the customer during account creation. This secure line of communication thwarts phishing attempts and unauthorized access, providing customers with peace of mind and you with confidence in the authenticity of online interactions.

Revolutionize Operations

Reduce risk

company-wide

Our identity assurance technology saves valuable time and prevents fraud at every risk point. Your tellers, site, app, and drive-through will know if you are interacting with the customer, not a bad actor. Our platform can drastically lower call times and take the pressure off your tellers so that they can focus on customer service.

Stay Digitally Progressive

Redefining the

financial space

Start with a digital-first experience. Stay ahead of the curve by seamlessly integrating our technology into your existing operations. You can innovate with ease, knowing you have a future-ready platform for your customers.